Correction: Maximizing Compounded Rate of Return

A few readers pointed out a typo and an arithmetic error in my article "Maximizing Compounded Rate of Return". In the geometric random walk example where the stock can go up or down 1% at every step, the mean rate of return m is 0%, (not 1%), and the compounded rate of return is -0.005% (not -0.5%). My sincere thanks to all my readers who mercilessly scrutinize my ideas and check my numbers!

Reader suggested a possible trading strategy with the GLD - GDX spread

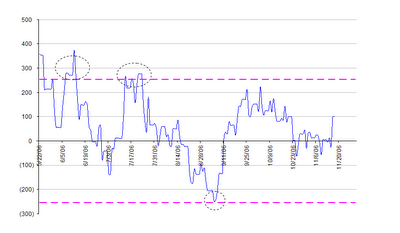

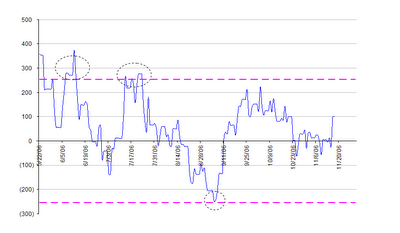

Steve Hansen of Raymond James Ltd. in Vancouver, B.C. suggested to me that a good trading signal for the GLD - GDX spread is when it exceeds 2 standard deviations from its mean. He observed that these are roughly at +/- $250 based on my definition of the spread, and that there were 3 such (immensely profitable) signals since the inception of GDX. Here is Mr. Hansen's plot:

This certainly looks like a fairly safe strategy. Of course, if one desires more frequent signals, one can always enter into smaller positions at smaller spread values.

By the way, just when we were celebrating the reversion of the GLD - GDX spread this morning, the QM - XLE spread plunged to another multi-year low. With crude oil prices down about 30% from its all-time-high, XLE, the energy stocks ETF, is still within 5% of its all-time high. Does this make any sense? We shall see after this quarter's earnings from the oil companies are announced ...

This certainly looks like a fairly safe strategy. Of course, if one desires more frequent signals, one can always enter into smaller positions at smaller spread values.

By the way, just when we were celebrating the reversion of the GLD - GDX spread this morning, the QM - XLE spread plunged to another multi-year low. With crude oil prices down about 30% from its all-time-high, XLE, the energy stocks ETF, is still within 5% of its all-time high. Does this make any sense? We shall see after this quarter's earnings from the oil companies are announced ...

GLD-GDX spread reverted to 0 this morning

Just a quick note on the GLD-GDX spread that I have been talking about. This morning (Nov 17) the negative spread completely reverted and has gone into positive territory.

Subscribe to:

Comments (Atom)

Subscribe

Subscribe